How's Our Real Estate Market Been Affected In The Last 4 Weeks Due to COVID-19?

(April 17, 2020

)

For those who wish to navigate the current market a number of safety precautions must be put in place for both selling and buying properties. We are utilizing Virtual Tours, among other things, prior to a property being shown. And indemnity waivers are being asked to be executed prior to properties being available to view in person.

CoVid19 has impacted every industry and Real Estate is no exception. The impact for Real Estate was markedly noticed mid March when sales volumes started to decrease. Since there is no precedent for the current market situation our plan is to keep you informed with a real-time “Market Snap Shot” around mid-month of every month during this pandemic. And, of course, we will send out our monthly stats packages to you, separately, within the 1st 7 days of each month and this will include YOUR AREA. Let's see what some of the numbers are telling us.

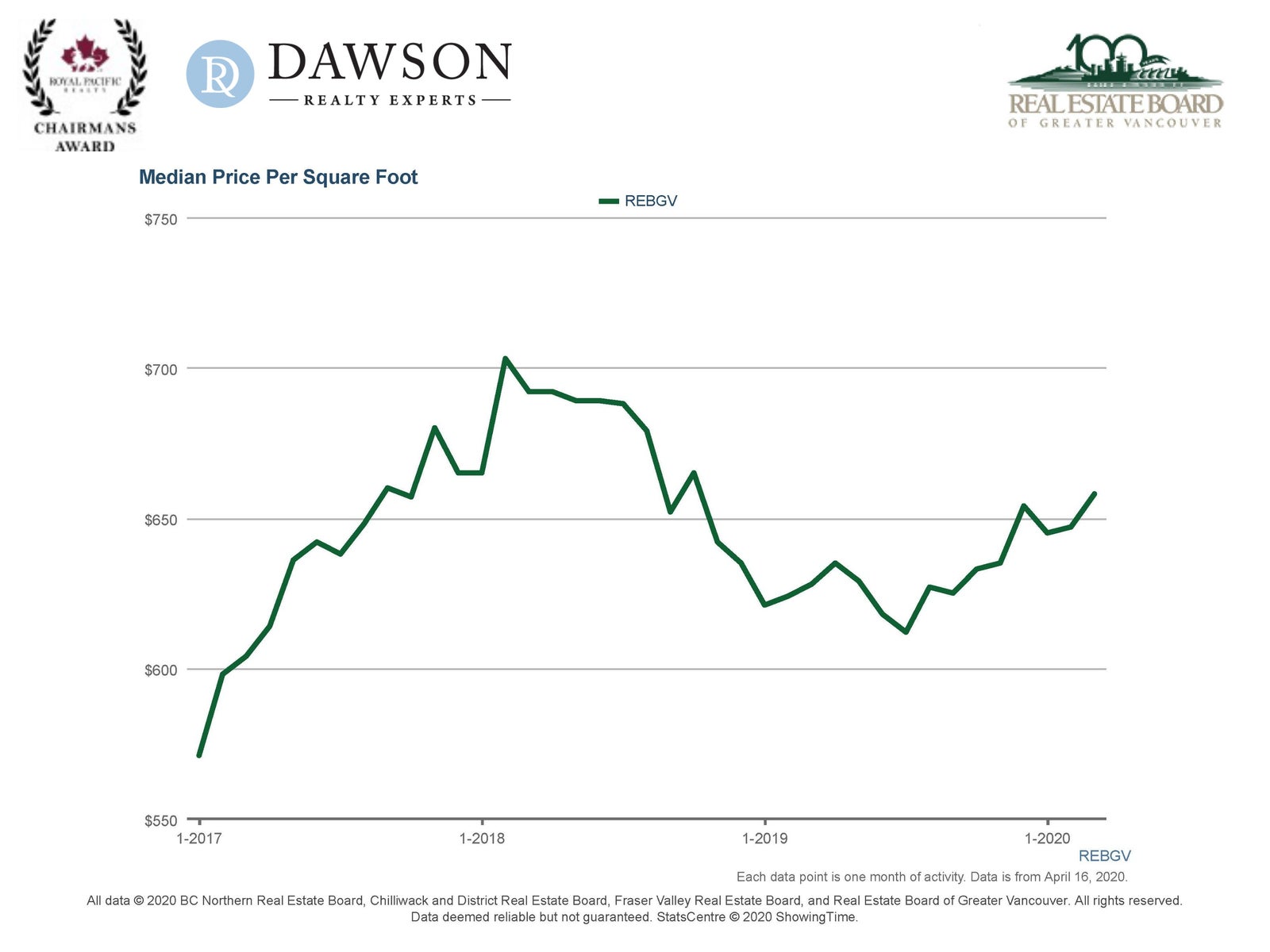

SALE PRICES:

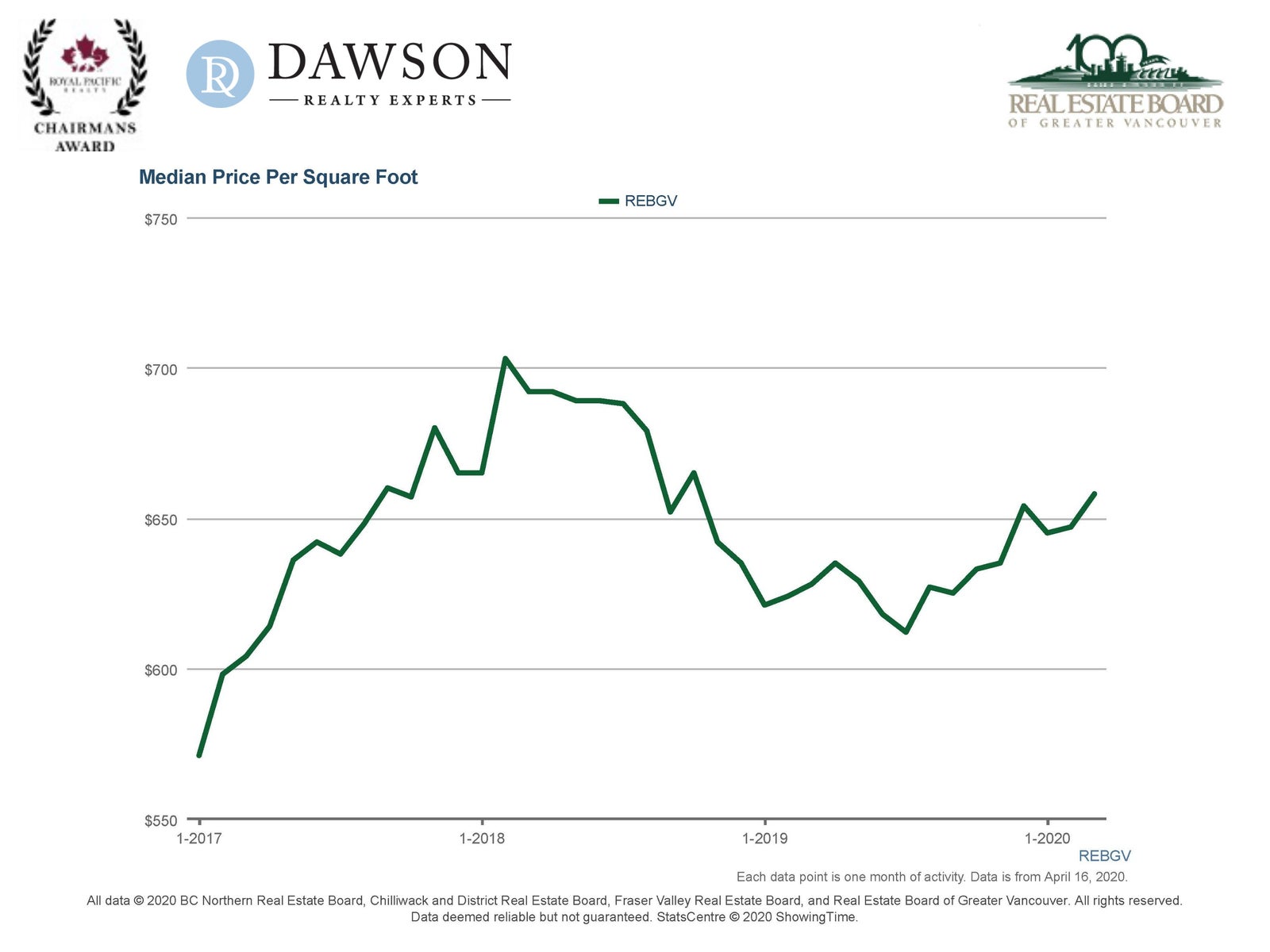

MEDIAN PRICE PER SQUARE FOOT graph 2017 to April 1st 2020:

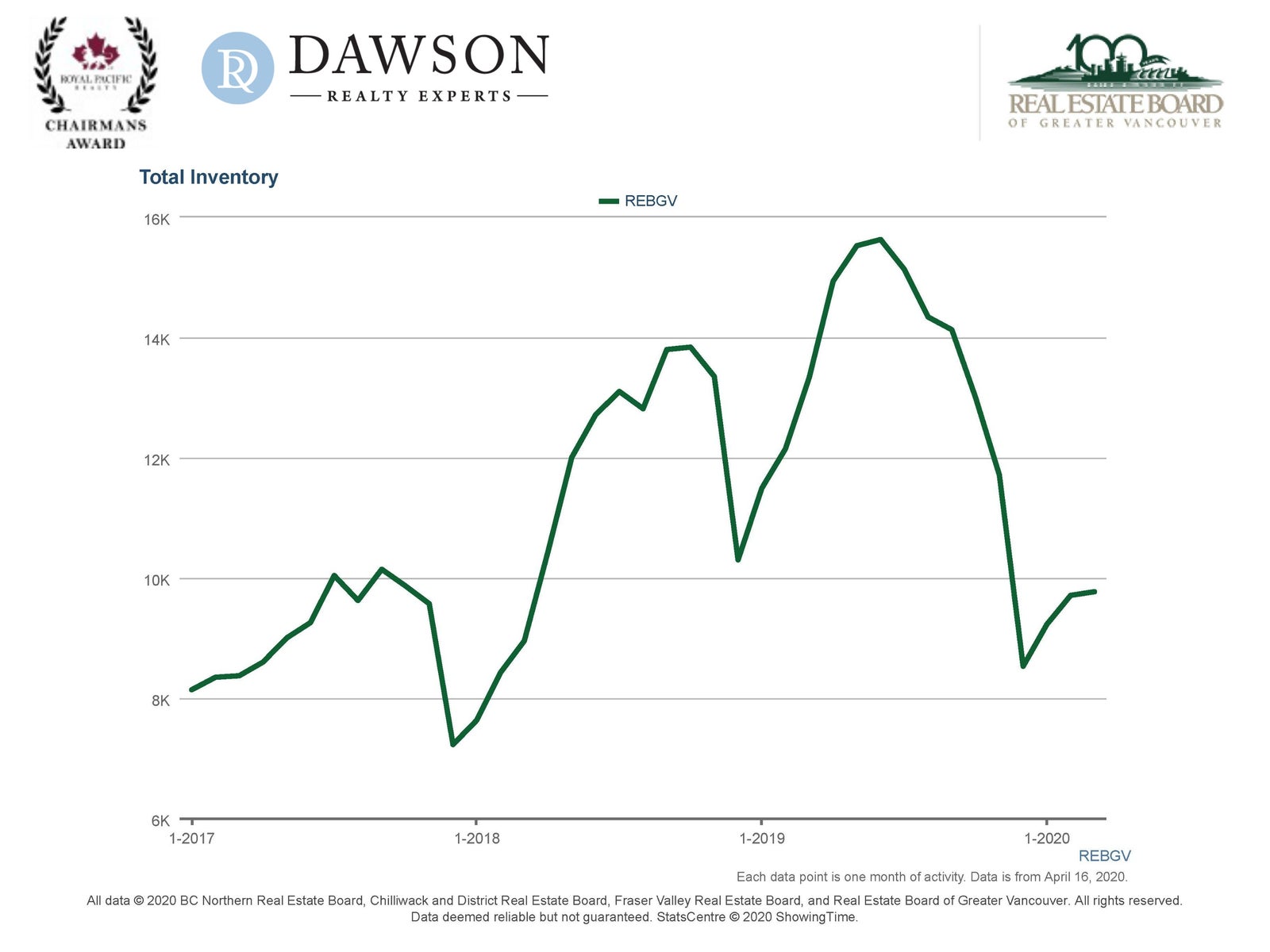

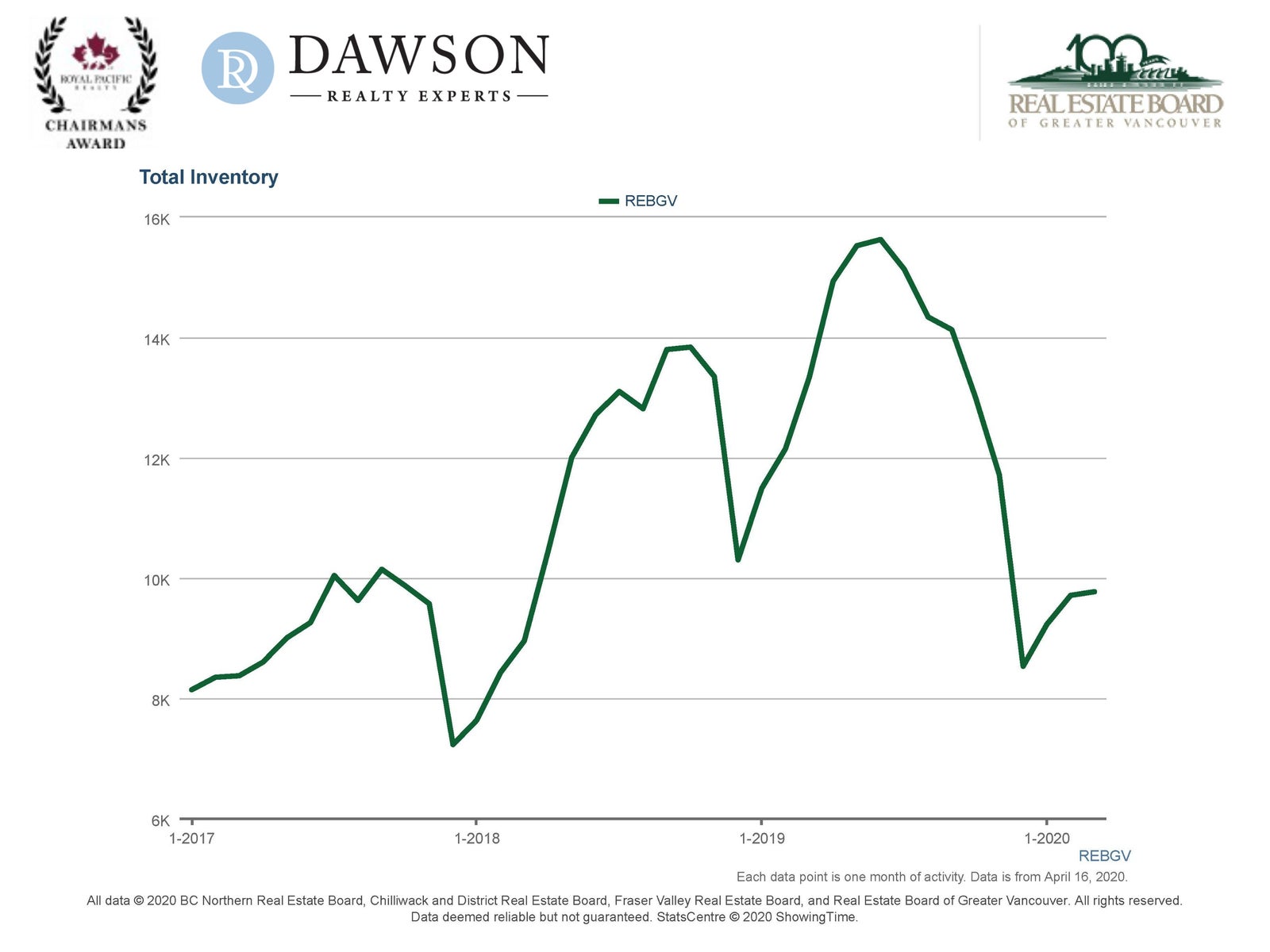

TOTAL INVENTORY GRAPH 2017 TO APRIL 1ST 2020:

It will be interesting to see the inventory numbers at the end of April 2020.

SUPPLY VS DEMAND PRINCIPAL:

Real Estate, not unlike other industries, works primarily on supply vs demand. And as you may know, less demand = higher supply. Since just prior to December 2019 overall supply (listings/units)dropped and demand increased and this helped contribute to higher prices. For March 2020 the supply (listing inventory) for resale properties was down↓25% compared to the 10 year average.

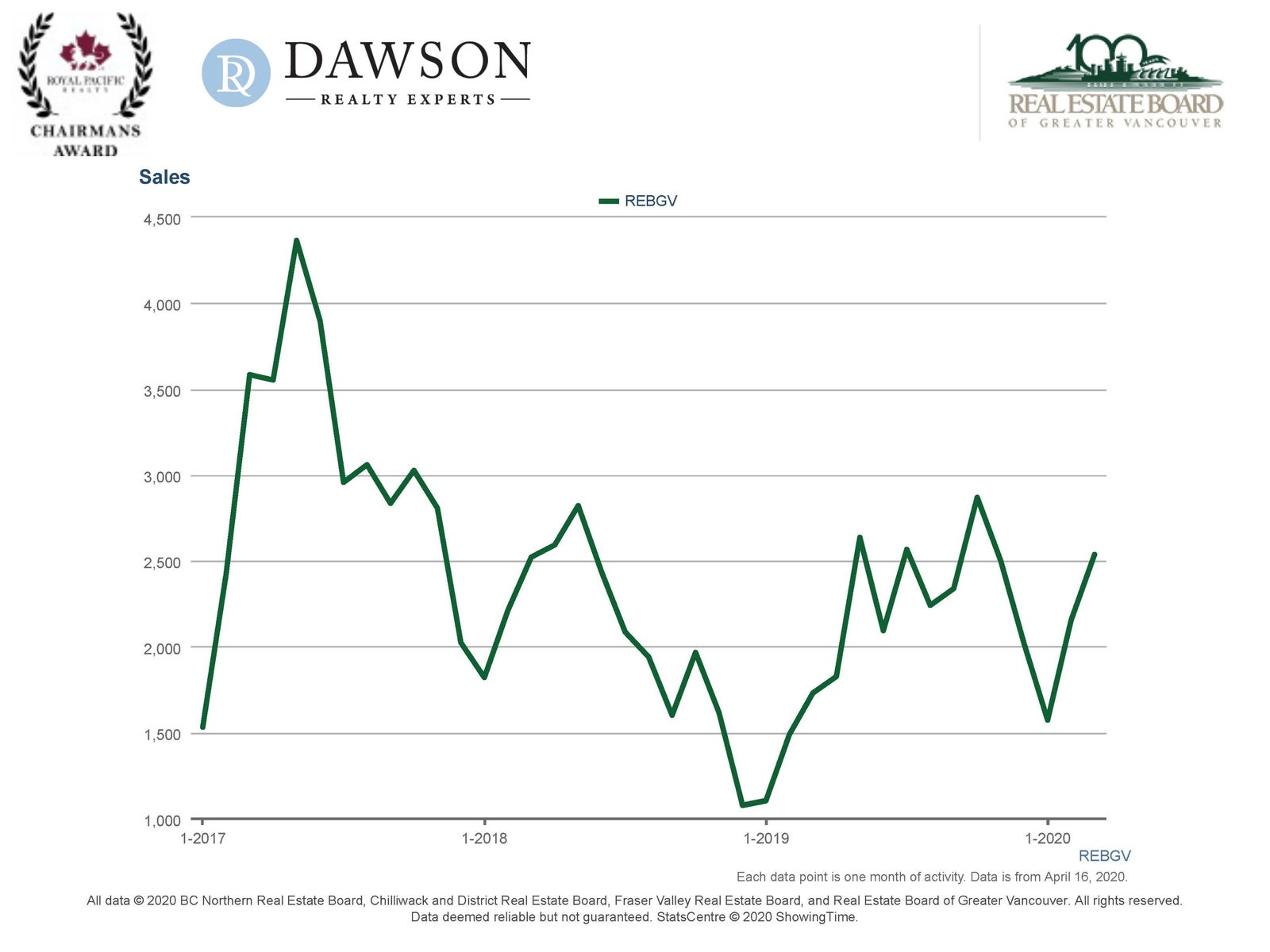

INVENTORY & sales volumes:

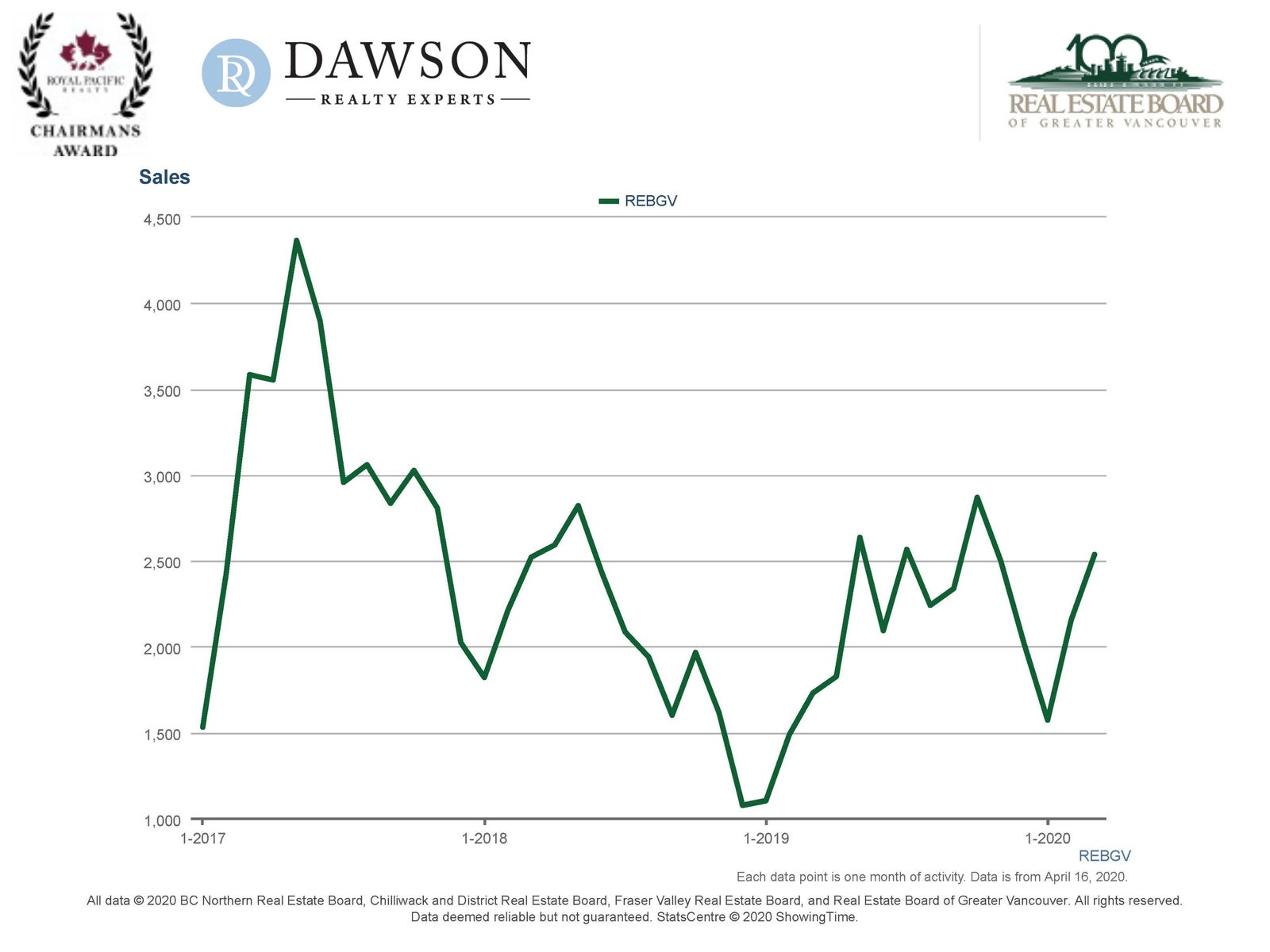

Change in the real estate market is normally 1st indicated by the number of units sold. Generally, as units sold increase, prices normally follow over a period of time, depending on a number of factors such as interest rates, available inventory and of course, the overall economic climate. Prices will typically fall when lower sales volume (units) is accompanied by increased inventory.

For March 2020 the resale sales volume (units) recorded on MLS, fell↓8% in the 2nd half of the month when compared to the 1st half of March. Compare this to March 2019 when the sales volume (units) increased by ↑3% in the 2nd half of that month. And in March 2020 there was a total of 10,315 properties listed and 2562 sales noted on MLS in the REBGV (Real Estate Board of Greater Vancouver). Also, from April 1st thru the 15th there were 1220 new listings in the REBGV for a total of 9980 active listings. And during the same period there has been 643 properties Sold. That is an average of 43 units per day sold. The average price per unit was $1,007,168. Last year's total was 123 units per day sold with an average per unit of $1,016,888.

The “take-away”: when comparing April 1-15 2020 with the same period in 2019; total sold units are ↓65% while the average selling price is ↓.009%)

A tell tale number in March 2020 are the withdrawn listings which rose by↑29% between the 1st and 2nd half of March. This is likely attributed to many Sellers who would rather wait CoVid19 out and then consider listing again when the virus threat has passed.

SALES VOLUME GRAPH 2017- APRIL 1ST 2020:

It will be interesting to see the expected difference at the end of April 2020.

SALE PRICES:

Over the past 6 months, since hitting bottom in September 2019 sale prices, including per square foot, have increased. The average sales price for the month of April 2020 is over 13% lower than March 2020 This may be an indication that a greater number of lower priced properties have sold in April compared to March. However, surprisingly from April 1 to 15th approximately 23% of the homes purchased during the period sold at or above the asking price. The 23% is attributed primarily to sales below $1 million dollars. And we have seen multiple offers for condos particularly under $900,000 in April 2020.

A recent article at www.citynews1130.com quotes industry experts who state given the low supply of residential properties on the market in the region, prices are not expected to move much despite sales slowing down to a trickle and the economy taking a hit. "It is unlikely we're going to see prices increase...but we also don't think they are going to decrease a great deal, either." And "year over year unit sales for the 1st quarter (January thru March 2020) were nearly 47 per cent higher than the same time a year ago, and that we were starting to see price appreciation again," Ash explains.

According to Elton Ash, Regional Vice-President of a large Real Estate Brokerage in Western Canada, "As we come out of the CoVid-19 crisis, economically, the real estate market will pick up relatively quickly, " he projects. "Because the economic slowdown wasn't based on real estate or true economic factors, this was health related. So I mean, that is the big question mark. How quickly can the economy start to go again, but with the reduction of interest rates by the Bank of Canada, the pent up demand in the Greater Vancouver area is all pointing to a significant return to a strong market once things start to return to some kind of normal."

MEDIAN PRICE PER SQUARE FOOT graph 2017 to April 1st 2020:

It will be interesting to see the difference, if any, at the end of April 2020.

TOTAL INVENTORY GRAPH 2017 TO APRIL 1ST 2020:

It will be interesting to see the inventory numbers at the end of April 2020.

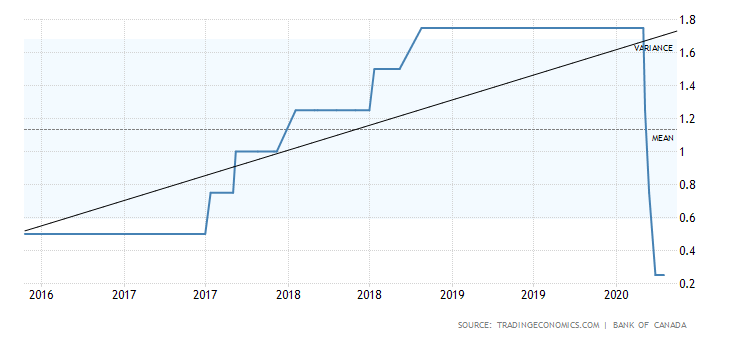

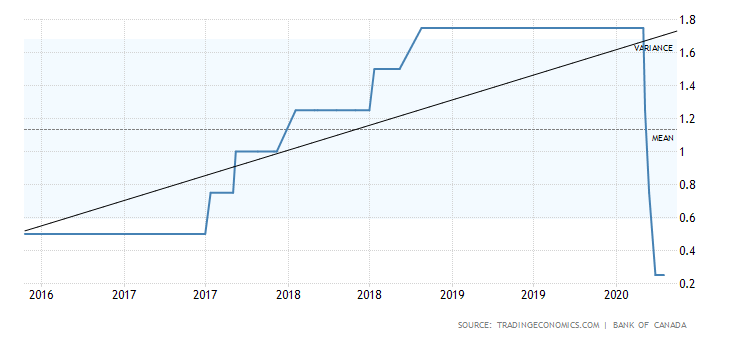

INTEREST RATES:

In an unscheduled emergency meeting, in collaboration with the OSFI or the Office of the Superintendent of Financial Institutions and the Ministry of Finance, such that the Bank of Canada (BOC) lowered its overnight rate by another 50 basis points to 0.75% and as well, many other supportive measures for the Canadian economy were announced. Also, on March 27, 2020, in another unscheduled emergency meeting, the BOC lowered its overnight rate again by 50 basis points to 0.25%. As of April 15, 2020 the BOC has left its key interest rate at 0.25%.The BOC says its worst-case scenario is for the economy to shrink by as much as 30% annualized in the second quarter. "Policymakers said they had taken measures aiming to help restore confidence and stimulate spending by consumers and businesses amid the Coronavirus pandemic. The Committee added that they will continue to purchase at least CAD 5 billion in Government of Canada securities per week in the secondary market; they will increase the level of purchases as required to maintain proper functioning of the government bond market and they will temporarily raise the amount of Treasury Bills it acquires. Policymakers also announced a new Provincial Bond Purchase Program of up to CAD 50 billion; and a Corporate Bond Purchase Program, in which the Bank will acquire up to a total of CAD 10 billion in investment grade corporate bonds in the secondary market. The Bank is also enhancing its term repo facility to permit funding for up to 24 months less.

In an unscheduled emergency meeting, in collaboration with the OSFI or the Office of the Superintendent of Financial Institutions and the Ministry of Finance, such that the Bank of Canada (BOC) lowered its overnight rate by another 50 basis points to 0.75% and as well, many other supportive measures for the Canadian economy were announced. Also, on March 27, 2020, in another unscheduled emergency meeting, the BOC lowered its overnight rate again by 50 basis points to 0.25%. As of April 15, 2020 the BOC has left its key interest rate at 0.25%.The BOC says its worst-case scenario is for the economy to shrink by as much as 30% annualized in the second quarter. "Policymakers said they had taken measures aiming to help restore confidence and stimulate spending by consumers and businesses amid the Coronavirus pandemic. The Committee added that they will continue to purchase at least CAD 5 billion in Government of Canada securities per week in the secondary market; they will increase the level of purchases as required to maintain proper functioning of the government bond market and they will temporarily raise the amount of Treasury Bills it acquires. Policymakers also announced a new Provincial Bond Purchase Program of up to CAD 50 billion; and a Corporate Bond Purchase Program, in which the Bank will acquire up to a total of CAD 10 billion in investment grade corporate bonds in the secondary market. The Bank is also enhancing its term repo facility to permit funding for up to 24 months less.

The OSFI an independent agency of the Government of Canada, established in 1987 to contribute to the safety and soundness of the Canadian financial system.

Below is a graph of the BOC historical rates since 2016:

All six of the majority banks in Canada passed on discounts to consumers and businesses by reducing their Prime lending rates. These reductions affect loans that are based off PRIME lending rates such as Lines of Credit, Variable Rate Mortgage and new or renewal mortgages.

Those searching for lower fixed mortgage rates may be surprised to see that in many cases those rates have increased. The Banks position is that credit is going to tighten in the coming months because the banks may question the sustainability of a client's employment. Therefore, we may see qualifying for a mortgage or loan more of a challenge over the next few months. Or until the big six banks in Canada believe CoVid19 is in the rear view mirror and income levels are steady once again. If you are renewing financing, your mortgage or applying for a new mortgage you may wish to consider a variable rate mortgage, that you can lock the rate in without penalty when you wish. Talk to your financial advisor in this regard. The next scheduled BOC rate announcement is June 15, 2020.

Those searching for lower fixed mortgage rates may be surprised to see that in many cases those rates have increased. The Banks position is that credit is going to tighten in the coming months because the banks may question the sustainability of a client's employment. Therefore, we may see qualifying for a mortgage or loan more of a challenge over the next few months. Or until the big six banks in Canada believe CoVid19 is in the rear view mirror and income levels are steady once again. If you are renewing financing, your mortgage or applying for a new mortgage you may wish to consider a variable rate mortgage, that you can lock the rate in without penalty when you wish. Talk to your financial advisor in this regard. The next scheduled BOC rate announcement is June 15, 2020.

MORTGAGE DEFERRAL:

Many financial institutions, in the hope to curb insolvencies or mortgage foreclosures launched a mortgage deferral program a number of weeks ago which will permit mortgage holders to apply for a 3-6 month reprieve on their weekly, bi-monthly or monthly mortgage payments. Since this announcement approximately 500,000+ applications have been approved which represents about 10% of all outstanding mortgages in Canada. It is expected this number will grow over the coming months. Heading into the CoVid19 pandemic mortgage arrears were at a 25 year low even with Canadians households holding the highest debt to GDP in the G7. Note: to the best of our knowledge, as of this writing, mortgage deferrals are not eligible for new mortgages with the big 6 banks.

Many financial institutions, in the hope to curb insolvencies or mortgage foreclosures launched a mortgage deferral program a number of weeks ago which will permit mortgage holders to apply for a 3-6 month reprieve on their weekly, bi-monthly or monthly mortgage payments. Since this announcement approximately 500,000+ applications have been approved which represents about 10% of all outstanding mortgages in Canada. It is expected this number will grow over the coming months. Heading into the CoVid19 pandemic mortgage arrears were at a 25 year low even with Canadians households holding the highest debt to GDP in the G7. Note: to the best of our knowledge, as of this writing, mortgage deferrals are not eligible for new mortgages with the big 6 banks.

RESALE PROPERTIES WITH SUITES:

The BC Government announced a moratorium on tenant evictions as a response to theCOVID-19 pandemic in an attempt to ensure secure housing for those that may lose their job. While the Government is trying to assist renters and landlords with a $500 a month subsidy this will not cover the potential rental losses that may be suffered each month. This rent relief is in addition to the a one-time payment of $1000 to B.C. residents who have lost income due to the crisis. The payment will be available to people who are eligible to receive Federal Employment Insurance and the new Canada Emergency Response Benefit (CERB). For further info:https://www.canada.ca/en/services/benefits/ei/cerb-application.htmlEarly stats are showing approximately 33% of all residential tenants in B.C. have not paid their rent for April 1st. The job losses have been felt primarily since mid March 2020. It is expected these will increase. Therefore, who will purchase a home with a tenant(s) while these current policies are in place? A Buyer is put in the position of not knowing a date they can expect vacant possession? Will this affect the demand and value of these properties? We think likely. And if so, will there be those who see an opportunity? For further information see the following link: https://www2.gov.bc.ca/gov/content/housing-tenancy/residential-tenancies/covid-19

CONVEYANCING DURING COVID-19:

The Bar Association has been working with Land Title to allow for properties to transfer during the CoVid-10 pandemic. Please note: NOTE ALL LENDERS ALLOW FOR THIS, yet. You will need to check with your lender.According to Spagnuolo & Company Lawyers, clients can now be meet via video technology to have documents witnessed for their purchase, sale or mortgage. There are some provisos, such as, the following:

· Clients should be able to print documents, meet on Zoom, sign in front of the screen, and then return the documents to us (scan and email, or dropped off to our Coquitlam office).

· and a few other little things to check with your conveyancing lawyer or Notary in order to eliminate the need to meet in person.

SUMMARY:

The current real estate market situation, due to COVID-19, is demanding and challenging. However, in every situation, there are opportunities and silver linings. Believe it or not, a silver lining may be that the current economic climate is a result of a health-related matter and not due to other underlying economic problems. In fact, prior to COVID-19 the economy in Canada and many other places around the world were strong. Over 151 countries around the world have been affected by the COVID-19 pandemic. Therefore, WE are all in this together. And we believe we will come out stronger and wiser. And hopefully, with much greater respect for Mother Nature and the warnings WE are currently being given. Perhaps it is time to have a good conversation about implementing worldwide animal welfare laws, among other things, by Governments around the world, for both domestic and wild animals in order to mitigate the chances of yet another deadly virus mutating from inhumanely, mistreated, animals to humans like COVID-19 as well as others in the past. With current technology, among other things, the monitoring and enforcement of these laws should be easily achievable. And for those who are still having a hard time to fully endorse and respect Mother Nature and all her creatures, perhaps the fact that this pandemic has cost Canada and other economies, jointly, around the world trillions of dollars may be incentive enough to want to "roll up the sleeves" to bring about a much needed change. Let's hope so. Either rationale will be a "win win" for all concerned.

SUMMARY:

The current real estate market situation, due to COVID-19, is demanding and challenging. However, in every situation, there are opportunities and silver linings. Believe it or not, a silver lining may be that the current economic climate is a result of a health-related matter and not due to other underlying economic problems. In fact, prior to COVID-19 the economy in Canada and many other places around the world were strong. Over 151 countries around the world have been affected by the COVID-19 pandemic. Therefore, WE are all in this together. And we believe we will come out stronger and wiser. And hopefully, with much greater respect for Mother Nature and the warnings WE are currently being given. Perhaps it is time to have a good conversation about implementing worldwide animal welfare laws, among other things, by Governments around the world, for both domestic and wild animals in order to mitigate the chances of yet another deadly virus mutating from inhumanely, mistreated, animals to humans like COVID-19 as well as others in the past. With current technology, among other things, the monitoring and enforcement of these laws should be easily achievable. And for those who are still having a hard time to fully endorse and respect Mother Nature and all her creatures, perhaps the fact that this pandemic has cost Canada and other economies, jointly, around the world trillions of dollars may be incentive enough to want to "roll up the sleeves" to bring about a much needed change. Let's hope so. Either rationale will be a "win win" for all concerned.

We are here for you to help you, with our expertise, in this unprecedented market. We know that this mandated economic shutdown has an end to it. Our Canadian Government has acted as quickly as possible to provide Canadians with a Federal economic stabilization package. And this along with the various stimulus plans of the B.C. Government and the BOC (Bank of Canada) aggressive monetary interest rate policies, among other things, including a little known tool in their tool box called "Quantitive Easing" are all aimed at providing a bridge, over troubled water, between where we are now and where we need to be. For further details on "Quantitative Easing" see the following link: http://behindthenumbers.ca/2020/04/08/canada-joins-the-qe-club-what-is-quantitative-easing-and-what-comes-next/

We will be here for you every step of the way and would be honoured to help you with all of your real estate needs whether it is a question, concern or if you just wish to chat. And if you need assistance in any other areas we will do our best to help steer you to other professionals who can offer you expert guidance. We are fortunate to know many other experts in their respective fields. Our service to you in this regard is with "no strings" attached. We love to feel needed!

Contact us anytime for a FREE real estate chat...

Sheryl Dawson 604 209-3118 sheryl@dawsonrealtyexperts.com

Mark Deans 604 328-7991 mark@dawsonrealtyexperts.com

Alice Lin 604 617-6821 alice@dawsonrealtyexperts.com

This information set our herein (the "information”) is intended for informational purposes only. While deemed to be from reliable sources the information has not been verified and we do not represent, warrant or guarantee the accuracy, correctness and completeness And we do not assume any responsibility or liability of any kind in connection with the information and the recipient’s reliance upon the information. The recipient of the information should take steps as the recipient may deem necessary to verify the information prior to placing any reliance upon the information. This document and information is not intended to create or cause a breach of an existing Agency relationship.

Categories

- All Entries (548)

- December 2017 (2)

- January 2018 (2)

- February 2018 (2)

- March 2018 (2)

- April 2018 (2)

- May 2018 (2)

- June 2018 (2)

- July 2018 (2)

- September 2018 (2)

- October 2018 (2)

- November 2018 (2)

- December 2018 (2)

- January 2019 (3)

- February 2019 (2)

- March 2019 (2)

- April 2019 (2)

- May 2019 (2)

- June 2019 (2)

- July 2019 (2)

- August 2019 (2)

- September 2019 (2)

- October 2019 (2)

- November 2019 (2)

- December 2019 (3)

- February 2020 (2)

- March 2020 (1)

- April 2020 (2)

- May 2020 (2)

- June 2020 (2)

- July 2020 (2)

- August 2020 (2)

- September 2020 (2)

- October 2020 (2)

- November 2020 (2)

- December 2020 (2)

- January 2021 (2)

- February 2021 (2)

- March 2021 (2)

- April 2021 (3)

- May 2021 (1)

- July 2021 (2)

- August 2021 (2)

- September 2021 (2)

- October 2021 (2)

- November 2021 (2)

- December 2021 (2)

- January 2022 (2)

- February 2022 (2)

- March 2022 (2)

- April 2022 (2)

- June 2022 (2)

- July 2022 (2)

- August 2022 (2)

- September 2022 (2)

- October 2022 (2)

Archives

- April 2025 (1)

- March 2025 (3)

- February 2025 (3)

- January 2025 (3)

- December 2024 (3)

- November 2024 (3)

- October 2024 (3)

- September 2024 (3)

- August 2024 (3)

- July 2024 (3)

- June 2024 (5)

- May 2024 (1)

- April 2024 (1)

- March 2024 (3)

- February 2024 (5)

- January 2024 (3)

- December 2023 (4)

- November 2023 (3)

- October 2023 (5)

- September 2023 (3)

- August 2023 (3)

- July 2023 (3)

- June 2023 (3)

- May 2023 (3)

- April 2023 (3)

- March 2023 (3)

- February 2023 (3)

- January 2023 (7)

- December 2022 (3)

- November 2022 (3)

- October 2022 (3)

- September 2022 (3)

- August 2022 (3)

- July 2022 (3)

- June 2022 (3)

- May 2022 (3)

- April 2022 (3)

- March 2022 (3)

- February 2022 (2)

- January 2022 (4)

- December 2021 (3)

- November 2021 (3)

- October 2021 (3)

- September 2021 (3)

- August 2021 (5)

- July 2021 (3)

- June 2021 (3)

- May 2021 (3)

- April 2021 (3)

- March 2021 (3)

- February 2021 (5)

- January 2021 (3)

- December 2020 (3)

- November 2020 (3)

- October 2020 (3)

- September 2020 (3)

- August 2020 (4)

- July 2020 (4)

- June 2020 (4)

- May 2020 (4)

- April 2020 (5)

- March 2020 (4)

- February 2020 (3)

- January 2020 (5)

- December 2019 (3)

- November 2019 (3)

- October 2019 (3)

- September 2019 (3)

- August 2019 (3)

- July 2019 (3)

- June 2019 (3)

- May 2019 (3)

- April 2019 (3)

- March 2019 (3)

- February 2019 (3)

- January 2019 (3)

- December 2018 (3)

- November 2018 (3)

- October 2018 (3)

- September 2018 (3)

- August 2018 (3)

- July 2018 (2)

- June 2018 (2)

- May 2018 (3)

- April 2018 (3)

- March 2018 (5)

- February 2018 (3)

- January 2018 (3)

- December 2017 (2)

- November 2017 (3)

- October 2017 (2)

- September 2017 (2)

- August 2017 (2)

- July 2017 (2)

- June 2017 (2)

- May 2017 (2)

- April 2017 (2)

- March 2017 (4)

- February 2017 (7)

- January 2017 (23)

- December 2016 (31)

- November 2016 (22)

- October 2016 (34)

- September 2016 (28)

- August 2016 (2)

- July 2016 (9)

- June 2016 (2)

- May 2016 (21)

- April 2016 (14)

- March 2016 (28)

- February 2016 (9)

- January 2016 (11)

- December 2015 (2)

Subscribe To This Blog

Subscribe To This Blog